A CEO is a highest-ranking executive in a companies infrastructure.

Our role is to develop and implement high-level strategies supported by detailed systems carrying the happiness of our team, customers and vision of the massive transformative purpose. NBD:)

One of the main ingredients influencing outcomes is the financial performance of the company.

While you don’t need a degree in finance, masterful financial management and financial literacy is not taught to most people throughout our lives.

Only 57% of Americans classify themselves as ‘financially literate’.

What this means is that the majority of people in your organization don’t have a healthy relationship to money, and this will show in the way you operate.

I failed my first business at the age of 20, lost $20,000 of life savings and had to move back in with my parents.

I was big on vision and small on the management and systems needed to support that vision.

Going from living my best life in LA to living with my folks again in San Diego was quite a motivating experience. I love my parents, they are amazing and so grateful for their hospitality, however, that wasn’t the vibe I was looking for.

I learned from the mistakes I made and fast forward 20+ years and multiple million-dollar company exits, I am aligned with financial management and realise the pivotal role it plays in achieving my vision.

What Is Financial Management?

Consider that financial management is the most important aspect of your company.

So having the most skilled and innovative financial team members possible on top of sound financial systems is incredibly beneficial to your wellbeing.

Financial management refers to the planning, organizing, directing, and controlling of all financial undertakings in a company.

Its main objectives are:

- To maintain enough funds to run the company.

- Ensure investors get a return on their investment.

- Efficient use of funds.

- Create safe opportunities to invest in for capital preservation.

Why Is Financial Management Important?

The financial management department has numerous functions.

- Calculating capital required.

- Formation of capital structure.

- Investing capital.

- Allocation of profits.

- Effective money management.

- Financial control.

Many businesses fail because of poor financial management.

The image below demonstrates the benefits of financial management/ analytics and how it influences the decision-making process.

It can impact potential investments and lead to missed opportunities. Poor productivity and therefore profitability is also something that can happen.

If you’re not planning your budget around the purchasing or raw materials, you won’t have the resources you need for product creation, therefore, low productivity levels and output resulting in capped profitability.

One of the most undesirable impacts of poor financial management is a high debt burden.

Once you find yourself in a position where you can’t cover bills and overheads you leave your company open to difficulty when it comes to acquiring money from lenders.

The truth of the matter is if you’re not managing your budget, allocating it properly, monitoring cash flow, your company could fail.

What Does The Data Say?

What evidence do we have to support the importance of good financial management?

- 82% of businesses fail due to poor cash flow management.

- Listed companies are twice as likely to fail.

- 70% of companies fail before they reach the 10-year mark.

Companies Who Went Under Due To Poor Financial Management

- Blockbuster.

In 2004 while at its peak, Blockbuster employed more than 84,000 people worldwide.

Four years later it filed for bankruptcy due to being $900 million in debt. The company’s failure was then cemented by Netflix as the online streaming service started to build traction and put an end to high street video stores.

The funny thing is, Blockbuster actually had the opportunity to buy Netflix and due to reasons unknown (potentially a lack of available capital) they decided against it.

This is a clear demonstration of how opportunities can be missed if your finances aren’t in check.

- Woolworths

Founded in 1878 in New York, high street favourite Woolworths, went under in 2009 and rendered 27,000 people unemployed.

Many joked the reason it went under was due to customers stealing too much pick n’ mix, and was eventually put down to poor management, lack of progression, and an inability to compete in the market.

- Kmart

Imagine going bankrupt not once, but twice. This is exactly what happened with Kmart who went bankrupt and merged with Sears Holdings in 2004 and went bankrupt again 16 years later.

Sears went bankrupt due to declined sales and profits as well as mounting debts.

How To Spot The Signs Of Poor Financial Management

By now it should be clear as a CEO, keeping your finger on your company’s finances is one of your most important priorities.

It’s important for you to review the efficiency of your company and detect possible cash flow leaks that could potentially leave your company at risk.

Below are 5 ways you could elevate your company’s financial management.

- Measure your debt levels. Divide your debt by your equity to calculate your debt to equity ratio. For example, if you have $2,000,000 in equity and owe $10,000,000 in debt, your ratio is 1:5.

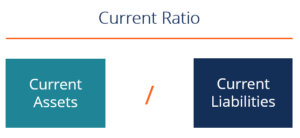

- Review your current cash ratio. Divide your total number of assets by your total number of liabilities.

- Create a master customer profile. Build a profile containing every conversation, transaction, quote, request and interaction. This empowers customer-facing staff to elevate their service and provides a wealth of data for decision making.

- Keep an eye on your profit margin. As revenue grows you can lose sight of your original KPIs. Monitoring your bottom line (total revenue minus total costs) means you always have sight of the bigger picture.

- Get predictive about customer data. The cost of a new customer is 5 times that of keeping a current one. A 5% increase in customer retention can increase revenue by up 95% so put a focus on customer experience.

Let’s Look At The Feelings & Beliefs Around Financial Management

UNDESIRED FEELINGS

- Disconnected

- Unsure

- Scarcity

- Anxious

- Guilt

UNDESIRED BELIEFS

- I feel disconnected from the company finances with everything else I must do.

- I’m unsure what direction to take the company to elevate our financial position.

- There are not enough customers in our industry for us to reach our massive goals

- Being in financial management meetings gives me anxiety.

- Deep inside I feel guilty for being focused on making more money

These undesired feelings and limiting beliefs may be hindering you and your company’s potential for growth and long term security in your current market.

Shifting your beliefs around financial management can help you introduce some in-depth management processes that allow you to effectively allocate funds, take advantage of opportunities, and increase profits and elevate the impact you make.

So let’s move on to the feelings and beliefs you can adopt that empower you to take your hiring process to the next level.

DESIRED FEELINGS

- Connected

- Wise

- Mindful

- Bold

- Empowered

EMPOWERING BELIEFS

- I feel connected with our company’s purpose and financial health so I can lead the company in the right direction.

- Our systems for analysis of finances empowers us to make wise choices.

- I am mindful of the bigger picture when it comes to current company finances and the state of the market we’re in.

- Knowing the condition of our finances allows me to take more bold yet calculated risks.

- I’m empowered by having a team of world-class financial managers who always keep me connected to company finances.

Action Steps To Create Masterful Financial Management

ACTION STEP 1] Check your company’s current liquidity.

This is quite a simple process.

Take the money you have available in the bank and divide it by your monthly expenses. This number will highlight how many months your company can operate if sales were to plummet.

While there’s no magic number stating how much cash reserves you should have, a good rule of thumb is to have cover for at least 12 months of business.

A second formula you can use is:

Take your cash and debtors and divide by your current liabilities (trade creditors + taxes owed). A number less than one is a warning of financial distress, whereas a figure >2 is a healthier place to be.

ACTION STEP 2] Keep an eye on Net Profit Margin.

As your company continues to grow you could lose sight of your original KPIs. Despite this, one of the key areas to focus on is Net Profit.

As you grow, increase profits, hire more team members and spend more time with clients it’s important you ensure your net profit margin is enough to cover expenses, invest in capital and pay a return to investors and shareholders.

To calculate your company’s net profit margin, take your net profit after all costs and divide it by your total revenue.

The larger the net profit margin, the better the outcome will be for your business financially.

ACTION STEP 3] Assess your sales pipeline.

Keeping track of leads as well as your current sales pipeline is a good indicator of whether your company is in a competent position financially or not.

Ensure you have a steady flow of warm/ hot leads to carry your company through the coming months.

A great resource to help you review whether your company is in a strong place financially is EFM’s Financial Management health check.

ACTION STEP 4] Utilize Systematic Financial Meeting Structures.

Hold a weekly and financial management meeting covering areas such as:

- A financial review

- Cashflow analysis

- A/R and A/P

- Financing needs

- Expectations

I also advise you to hold a weekly financial collaboration meeting covering:

- A review of the functionality and visibility of reports and how they can be improved.

- Critical issues on the daily running of the company.

- Strategic items requiring discussion.

For more information on the timings, frequency and agenda of these meetings you can view the image below on a larger scale here.

One of our CEO clients Jeff Smith, Founder and CEO of Scalable sold 4 of his companies with his most recent company exit at $60 million. In addition, he also saved over 15,000 lives in the process.

“One of the most remarkable things that Lifestyle Perfected has done for me, and this has been the case multiple times, is to within even just a single email or brief conversation, actually change the course of my business or objectives in a way to create total alignment and exponential enjoyment and profit for our company.”

If you’d like a complimentary consultation on your financial management processes or another area of business to elevate the alignment within your company, reply to this email or alternatively, you can see our programs for CEOs and for teams here.

We’re also excited to invite you to apply to CEO Circle. A group for CEOs to elevate emotional intelligence, increase impact and legacy wealth. If you are CEO and/or a founder with $1 million or more in revenue or assets apply here.

Sending you love,

Nadav

& the Lifestyle Perfected team